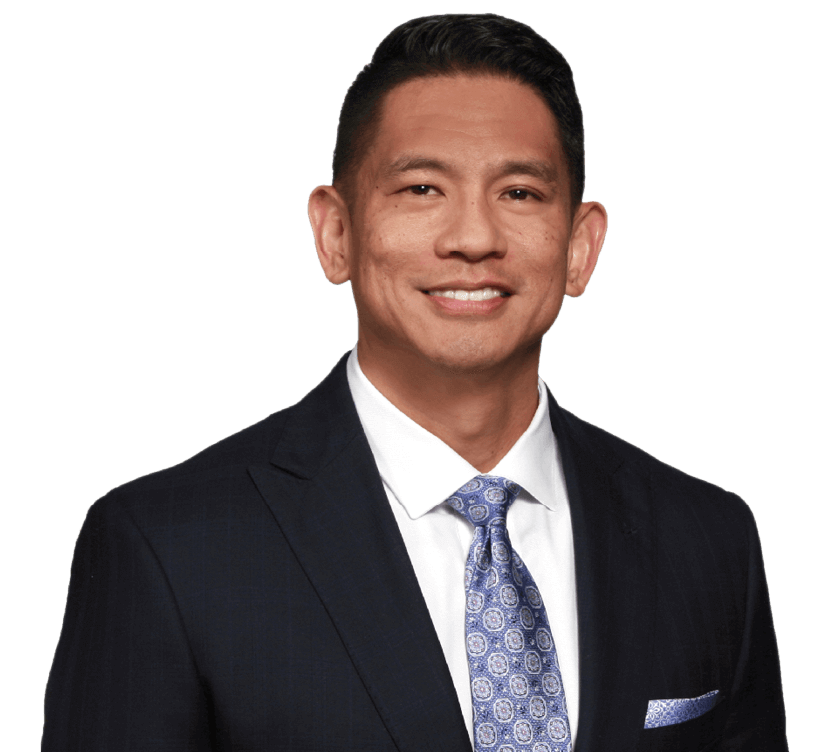

Michael Navarro represents his clients in the kind of important deals that can propel corporate growth and generate financial gains for a business.

He helps clients navigate the complexities of corporate law when the stakes are high, whether for mergers and acquisitions, equity or debt financing, real estate deals or other commercial transactions.

Michael’s clients operate across the U.S. and he has been involved in structuring, negotiating, and documenting a wide variety of business transactions across a multitude of industries including technology, healthcare, retail, restaurant, and real estate. Lately, many of his clients are companies expanding into Texas from California and New York, or relocating their corporate headquarters to take advantage of the robust economy and business-friendly environment Texas offers. Many clients engage Michael to serve in the role of outside general counsel after an initial representation in a specific deal because they value and appreciate his comprehensive understanding of the legal and business issues that companies face in complex transactions. With a background in intellectual property law, Michael brings additional value to his technology clients when navigating the additional complexities of licensing and other IP matters in corporate transactions.

Michael’s practice is heavily devoted to equity and debt transactions on behalf of emerging companies as well as representation of angel investors, private equity and venture capital on the investment side. He has a deep understanding of the regulatory issues that arise in corporate mergers and acquisitions and private equity deals, including fund formation and raising money in the capital markets. His corporate practice also includes the formation and ongoing representation of corporations, limited liability companies, partnerships, joint ventures and other entities as well as the individual owners of these enterprises.

Armed with extensive experience in real estate transactions, Michael represents clients in a multitude of real estate and real estate related transactions including buyers and sellers in the purchase and sale of commercial real estate, owners and developers in commercial real estate projects, and landlords and tenants in commercial leasing transactions. A significant portion of his real estate practice is focused on representing developers and real estate finance, including the representation of borrowers in balance sheet loan transactions, commercial mortgage-backed securities and other types of non-recourse financings. Michael’s real estate engagements include “dirt and sticks” transactions all the way up to the formation of real estate funds and private placements.

Away from the Office

Michael grew up in the country and still enjoys spending a lot of time outdoors with his three young sons.

Credentials

Bar Admissions

- State Bar of Texas

- State Bar of Nevada

- Registered to practice before the United States Patent and Trademark Office

Education

- South Texas College of Law, J.D., 2003

- Texas A&M University, B.S., 1999

Honors

- Anume Foundation, Inc. – Board of Directors

Experience

Real Estate Transactions

- Represents numerous regional and national restaurant chains in leasing transactions and entity structuring.

- Represents large California franchise operator in new restaurant concept entry into the Houston and Bryan-College Station market.

- Acts as general outside counsel for real estate investment firm in formation of real estate funds, private offerings and acquisitions, operations, and sales of commercial value-add real estate assets.

- Represents majority owner of developer entity in development of luxury multi-family project in San Antonio valued at approximately $74 million.

- Counseled tenant in $60 million build-to-suit single tenant industrial lease.

- Represented buyer in acquisition of single tenant industrial property for approximately $10 million.

- Represented buyer in acquisition of $26 million value-add office building in Houston, Texas including the non-recourse debt financing.

- Acts as general outside counsel for Colorado ranch comprised of approximately 400 square miles of controlled land in all real estate and corporate transactions

Recent Representations

- Represented waste management company in sale of substantially all of its assets for approximately $80 million.

- Represents medical technology startup in all corporate matters including structuring, equity offerings and intellectual property licensing.

- Represented family office private equity fund in Series Seed through Series C and convertible debt investments of emerging healthcare companies.

- Represented Austin-based construction firm in equity rollover acquisition of construction company.

- Represented numerous companies in corporate restructurings to optimize asset protection strategies.

- Represented manager in manager buyout of meat processing facility in Central Texas.

- Represented life sciences company stockholders in the sale of all of the company’s stock to a private equity fund for $45 million and rollover equity in the fund.

- Represented private equity fund in acquisition of numerous behavioral health companies.

- Represented numerous real estate funds in fund formation and private placements totaling over $100 million.

- Represented construction materials company in $10 million investment from private equity fund.

- Represented closely held corporation in stock redemption for $2 million concurrently with the purchase of real estate for approximately $8M and the restructuring of approximately $4 million of debt.

Notable Transactions and Representations

- Represented fifty percent (50%) owner of large privately held restaurant corporation in company deadlock issues.

- On behalf of the City of Las Vegas, assisted in the drafting and negotiations of the disposition and development agreement, the option agreement, and deed of trust for the $25M sale of downtown land which included the city hall building and a city parking garage to online retailer Zappo’s.

- On behalf of major developer, drafted complex disposition and development agreement with the City of Las Vegas Redevelopment Agency for the redevelopment of areas in downtown Las Vegas involving development investment of over $100 million.

- On behalf of landlord, negotiated and drafted lease agreements for two commercial retail properties with TESCO, a major grocery retailer from England entering the U.S. market.

- On behalf of landlord, negotiated and drafted lease agreements with national fast casual, fast food, and casual dining restaurants, national banks, and various office and industrial tenants.

- Represented hotel and casino operator in ITO transaction valued at $250 million which involved the handling of various complex employment, intellectual property, insurance, risk transfer, and regulatory matters.

- Counseled and negotiated on behalf of casino developer in the borrowing of $550 million and $125 million of subordinated debt.

- Represented buyer in potential purchase of major a casino property offered at $700 million.

- Represented buyer in purchase of two casino properties collectively offered for $200 million.