KRCL CARES: MAIN STREET LENDING TASK FORCE - A Comparison of the June 26, 2020 FAQs to the June 20, 2020 FAQs

On Friday, June 26th, the Federal Reserve circulated a revised version of its Frequently Asked Questions (FAQs) for the Main Street Lending ("MSL") Program. This blog reviews the five new FAQs that were added and the two minor changes that were made.Specifically, the new FAQs include H.12-H.14 relating to calculating total compensation as well as L.8 and L.9 relating to Eligible Borrower financial information and other inputs required by the Main Street Lender Portal. Two minor changes were also made to D.8 and D.12. FAQ D.12 discusses whether an Eligible Lender who sells a participation to the Main Street SPV can share its 5% retention of the MSELF Upsized Tranche with other members of a multi-lender Facility. FAQ D.12 was struck in its entirety and moved to FAQ D.12.

FAQs L.8 and L.9 are important developments to Main Street Lending. These two, new FAQs address the information Eligible Borrowers are required to submit to Eligible Lenders as well as the information Eligible Lenders must submit for each Main Street Loan through the Main Street Lending Portal. Accordingly, L.8 and L.9 are addressed first.

- L.8. What financial information is an Eligible Borrower required to submit to an Eligible Lender at the time of origination of a Main Street loan? What Eligible Borrower financial information is an Eligible Lender required to submit to the Main Street Portal with other loan participation documentation?

FAQ L.8 details what financial information an Eligible Borrower is required to submit to an Eligible Lender at the time of origination of a Main Street Loan, and what financial information an Eligible Lender is required to submit to the Main Street Portal.

For a Main Street loan that is originated after June 28, 2020, an Eligible Borrower must provide an Eligible Lender with two sets of financial information at the time of origination: (1) per section 4.A of the Borrower Certifications and Covenants, the Eligible Borrower must submit its 2019 financial records to its Eligible Lender (H.10 provides more information), and (2) the Eligible Borrower must submit financial data consisting of all the data fields required in Table II of Appendix C to the FAQs for the most recent quarter available at the time of origination of the Main Street loan.

Section L.8 describes in detail the portal input requirements for an Eligible Lender with regards to the Eligible Borrower providing its two sets for financial information.

In addition to submitting the Eligible Borrower's financial data, which is described above, to the Main Street portal with other loan participation documents at the time a Main Street Loan is submitted to the Main Street SPV for sale of a participation, the Eligible Lender must do the following: (1) input the Eligible Borrower's 2019 revenues, 2019 adjusted EBITDA, and the Eligible Borrower's total assets, current assets, and current liabilities as of December 31, 2019 into the Main Street Portal's data field; and (2) upload all other required 2019 financial data (in the format which the Eligible Borrower delivered to the Eligible Lender) to the Main Street Portal.

An Eligible Lender is also required to input all of the data fields set out in Table II Appendix C to the FAQs into the Main Street Lending Portal either: (1) at the time the other required documentation to sell a loan participation is submitted; or (2) at a later date, not to exceed (i) 60 days after the submission of the documentation required to sell a participation in the loan, or (ii) 15 business days after the Credit Monitoring module of the Main Street Portal becomes available, whichever is later.

If the loan was originate on or before June 28, 2020, the Eligible Borrower is only required to provide an Eligible Lender with "2019 Financial Information," and the Eligible Lender is only required to input this information into the portal. However, FAQ L.8 does discuss the steps an Eligible Lender should take if the Eligible Lender collected additional financial data for the most recent quarter at the time of origination from the Eligible Borrower.

An Eligible Lender may require the Borrower to submit other financial information according to their underwriting practices. Any data that is collected by the Eligible Lender should be uploaded to the Main Street Portal in the format in which the Eligible Borrower delivered to the Eligible Lender when the other required documentation to sell a loan participation is submitted.

- L.9. What information is an Eligible Lender required to submit to the Main Street Portal in connection with the submission of the documentation required to sell a loan participation to the Main Street SPV?

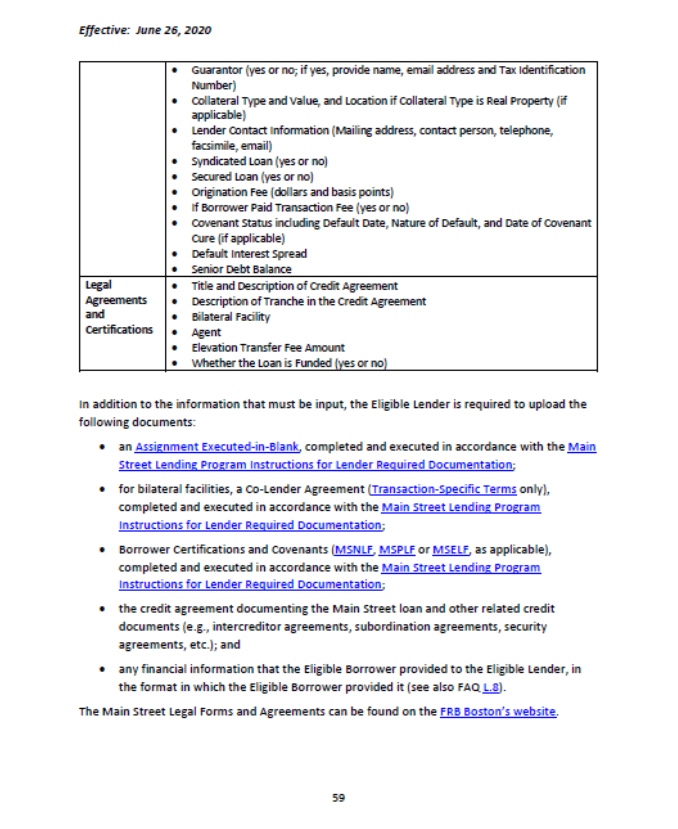

FAQ L.9 provides the following chart and information concerning the information an Eligible Lender must submit to the Main Street Portal in connection with the submission of the documentation required to sell a loan participation to the Main Street SPV in addition to the information that must be submitted per FAQ L.8.

- H.12. How should Eligible Borrowers calculate "total compensation" for purposes of complying with limits on compensation under the direct loan restrictions?

FAQ H.12 details how Eligible Borrowers should calculate "total compensation" in order to comply with the limits on compensation under the MSL direct loan restrictions. H.12 divides Eligible Borrowers into two categories: (1) Eligible Borrowers that are public companies; and (2) Eligible Borrowers that are not public companies.

Under FAQ H.12, total compensation includes the following: "salary, bonuses, awards of stock, and other financial benefits provided by the Eligible Borrower and its affiliates to an officer or employee of the Eligible Borrower, but does not include the value of severance pay or other benefits paid in connection with a termination of employment."

An Eligible Borrower that is public company must calculate total compensation according to the methodology set out in item 402(c) of Regulation S-K (item 402(c)) (17 CFR 229.402(c)(2)).

An Eligible Borrower that is not a public company may decide to calculation total compensation in a manner that is consistent with the federal tax rules if the Eligible Borrower meets the criteria for either: (1) small Eligible Borrowers that are not public companies, or (2) Officers and Employees that receive limited deferred compensation.

Regarding Small Eligible Borrowers that are not public companies, an Eligible Borrower will meet criteria if it had gross revenues for its financial year ending in 2019 of less than or equal to $10,000,000. If this criteria is met, then the Eligible Borrower may calculate total compensation in a manner consistent with the federal tax rules.

In order to meet the criteria provided for Officer and Employees that receive limited deferred compensation, an Eligible Borrower that is (1) not a public company, and (2) had gross revenues for its financial year ending in 2019 of greater than $10,000,000 may calculate compensation in a manner consistent with the federal tax rules for all officers or employees who are not "Significant Deferred Compensation Recipients". A Significant Deferred Compensation Recipient is defined as "an officer or employee who, during any 12-month period beginning January 2019 and until 12 months after the date on which the Main Street loan is no longer outstanding, has total compensation that exceeds $425,000, out of which the fair value of deferred compensation granted to such officer or employee exceeds 30 percent." An Eligible Borrower should use U.S. GAAP to determine whether its officers and employees qualify as Significant Deferred Compensation Recipients.

An Eligible Borrower who chooses not to calculate compensation in a manner consistent with the federal tax rules shall use item 402(c) to calculate total compensation.

After determining which method to sue in calculating total compensation, once the loan is disbursed, the Eligible Borrower must apply the chosen approach so long as the Main Street loan is outstanding and for 12 months after.

FAQ H.12 also states that total compensation under the federal tax rules includes elements of compensation to an officer or an employee who is either: (1) "an individual that the Eligible Borrower would be responsible for reporting compensation on Form W-2, and includes commissions, educational assistance, and benefits or wages that are paid in kind (such as meals or lodging) if they would be treated as taxable compensation subject to federal income tax withholding under [IRS] Code section 3401(a) …," or (2) "an individual who is a partner in a partnership or a member of a [LLC] or other similar structure, and includes' net earnings from self-employment' and 'guaranteed payments for services' that are subject to self-employment tax under [IRS] Code 1401(a) as payment in connection with the performance of services."

- H.13. What if an Eligible Borrower chooses, at the time of disbursement of the Main Street loan, to calculate total compensation using the federal tax rules for all officers or employees that were not Significant Deferred Compensation Recipients (as defined in question H.12) and the Eligible Borrower later increases the amount of deferred compensation so that one or more of these individuals become Significant Deferred Compensation Recipients?

FAQ H.13 poses the question as to what happens if an Eligible Borrower chooses, at the time of disbursement of the applicable Main Street loan, to calculate total compensation using the federal income tax rules for all officers or employees that were not Significant Deferred Compensation Recipients, and the Eligible Borrower later increases the amount of deferred compensation so that the individuals become Significant Deferred Compensation Recipients.

Once the employee or officer becomes a Significant Deferred Compensation Recipient, an Eligible Borrower must immediately begin calculating total compensation according to item 402(c) and continue to do so while the Main Street loan is outstanding and for 12 months afterwards.

However, an Eligible Borrower that meets the criteria provided in H.12(2)(a), i.e., has gross revenues for its financial year ending in 2019 of less than or equal to $10,000,000, at the time of loan disbursement and chooses to use the federal tax rules to calculate total compensation is not required to use item 402(c) for any employee or officer that is or becomes a Significant Deferred Compensation Recipient at any time, unless it becomes a public company.

- H.14. What if an Eligible Borrower that has chosen to calculate total compensation using the federal tax rules (as permitted by question H.12) later becomes a public company?

FAQ H.14 discusses how an Eligible Borrower must calculate total compensation if the Eligible Borrower later becomes a public company.

FAQ H.14 states:

Any Eligible Borrower that becomes a public company must calculate total compensation according to item 402(c). With respect to any officer or employee whose total compensation had been calculated in a manner consistent with the federal tax rules, the Eligible Borrower must begin calculating such individual's total compensation under item 402(c) immediately upon becoming a public company, and must include in their total compensation any deferred compensation granted but not paid in the 90-day period ending when the Eligible Borrower became a public company.

The KRCL Main Street Lending Task Force will be providing further updates concerning the status of the Main Street Lending Program. Once the program becomes operational, the KRCL Main Street Lending Task Force will assist Eligible Lenders and Eligible Borrowers in connection with the Main Street Lending Program.