Are Your Customers Complaining? CFPB Publishes Complaint Narratives About Financial Products And Services.

The Consumer Financial Protection Bureau ("CFPB") has a new complaints database. In accordance with its Financial Policy Statement issued on March 19, 2015, the CFPB has started publishing consumer complaint narratives. There are currently over 8,400 narratives in the database which the CFPB started collecting in March of this year and new complaints are added daily.

Each week the CFPB sends thousands of consumer complaints about financial products and services to companies for response. Complaints are listed in the database after the company responds or after it has had the complaint for 15 calendar days, whichever comes first. The CFPB publishes the consumer's description of what happened if the consumer opts to share it and after taking steps to remove personal information. The CFPB does not verify all the facts alleged in the complaints, but takes steps to confirm the existence of a commercial relationship between the parties.

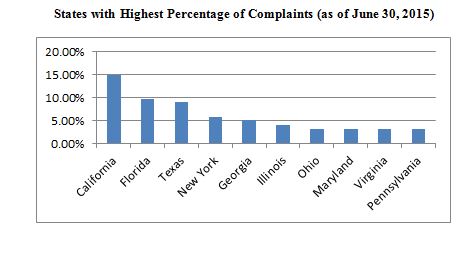

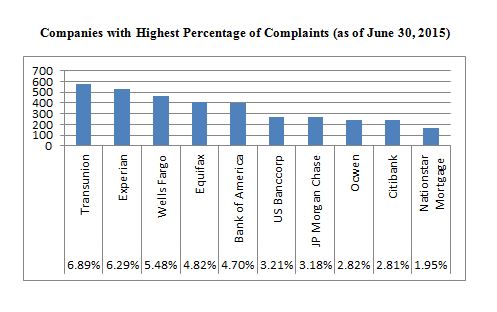

According to the CFPB, over half of the consumers making a complaint have opted to allow the CFPB to include the narrative of their complaints in the database. But what are consumers complaining about? Presently, complaints about mortgages, debt collection and credit reporting account for about 70% of the narratives received since March 19, 2015. Payday loans are at the other end of the spectrum and account for less than 1% of the narratives since March 19, 2015. In addition, some other interesting information can be derived from the data made available by the CFPB including the states from which the most complaints originate as well as the companies that have the most complaints filed against them. This information appears in the graphs below, but the CFPB makes the data available in a form that allows for easy analysis here. Are your customers complaining?